Financial Accounting Cash Flow Solved Numerical Questions | Part Two

What is a Cash Flow statement?

The Cash Flow statement is an integral part of the Financial Statements. It shows the amount and timing of money in and outflows, i.e., Cash received and paid to suppliers, employees, investors, etc. It also shows changes in the balance sheet (other than equity). The Cash Flow statement reports how much cash was generated or used by the firm, not how much profit was made.

What are the three types of Cash Flows?

There are three Cash Flow types that companies should track and analyze to determine the liquidity and solvency of the business:

- Cash Flow from operating activities,

- Cash Flow from investing activities, and

- Cash Flow from financing activities.

What is the purpose of the Cash Flow statement?

The Cash Flow statement tells you how your company got its cash balance at the beginning of the period compared to the end.

What are the two ways to prepare Cash Flow statements?

There are two ways to prepare a Cash Flow statement: the direct method and the indirect method.

What is the most important part of the Cash Flow statement?

The most important part of a Cash Flow statement is net income, which shows how much money a company earned during a given period.

These problems will help students clarify key concepts about cash flow statements and to ready themselves for their exams and interviews.

Problem 1

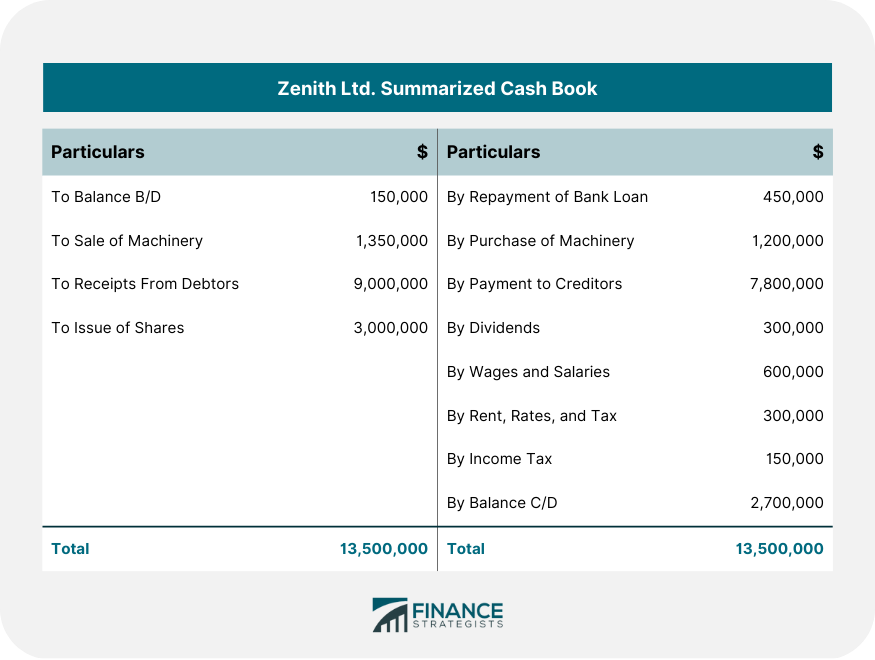

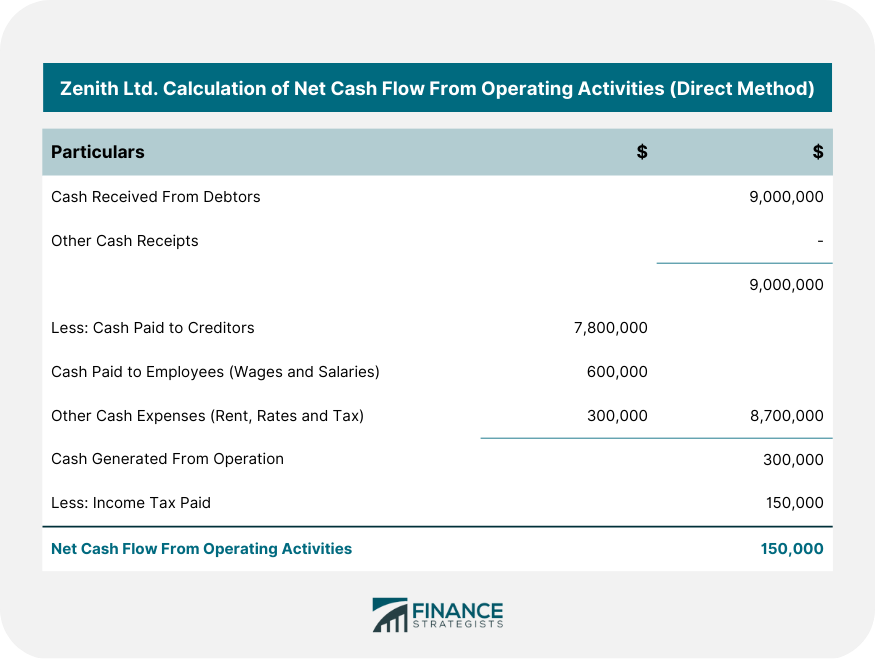

From the summarized cash book of Zenith Ltd. shown below, calculate net cash flow from operating activities.

Solution

Problem 2

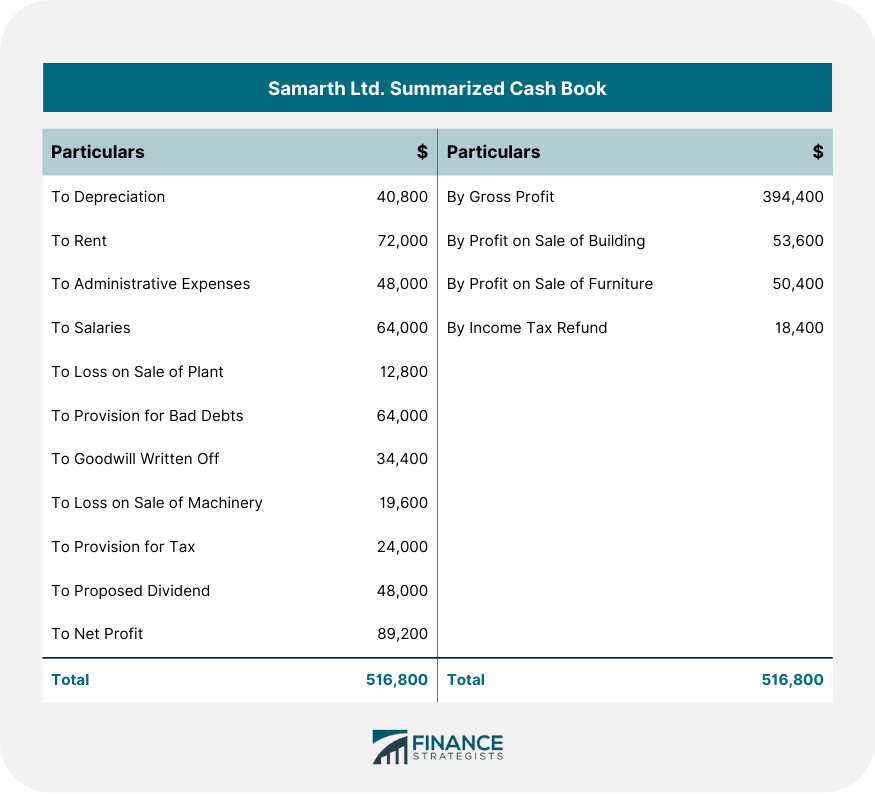

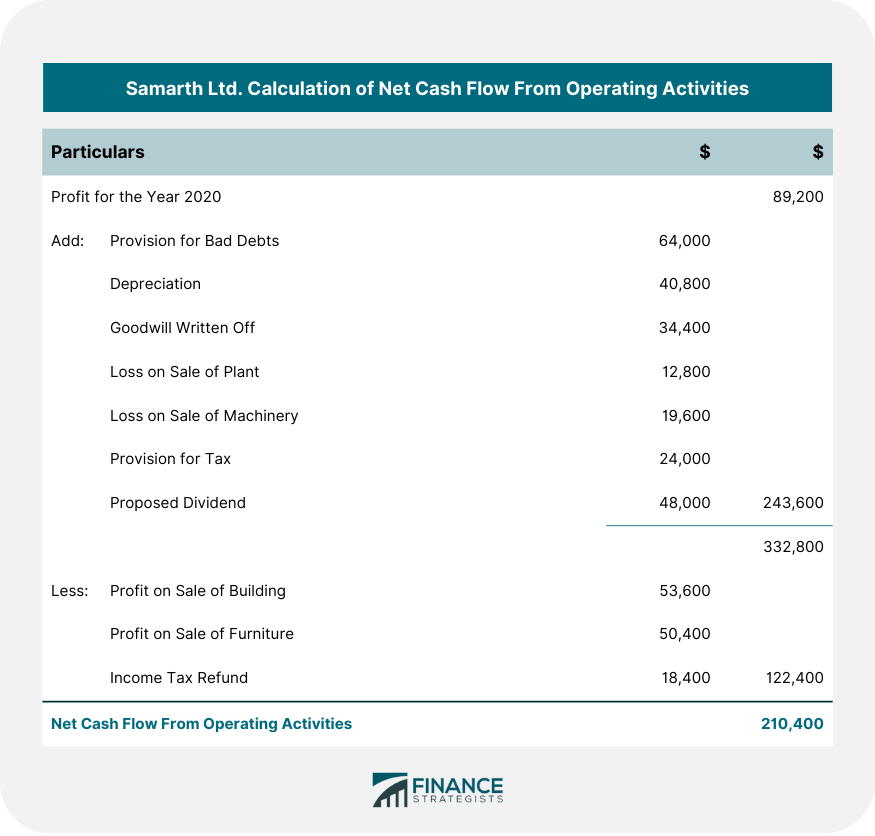

From the following profit and loss account of Samarth Ltd., calculate net cash flows from operating activities.

Solution

Problem 3

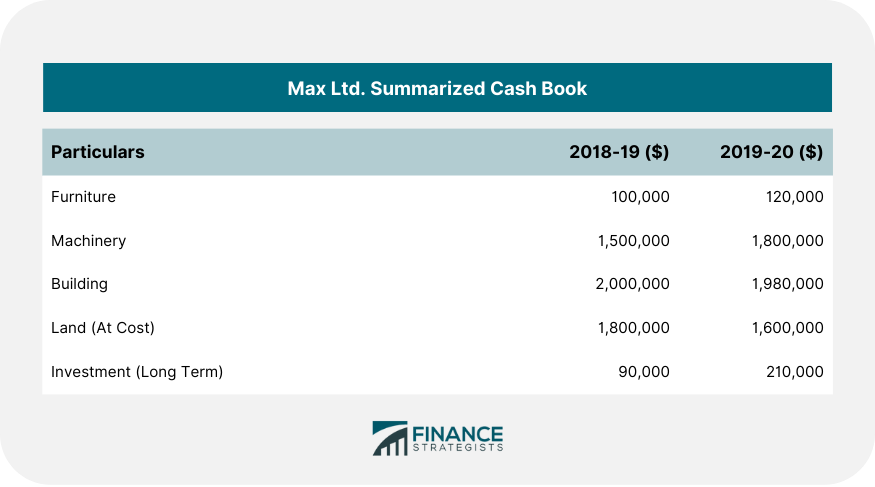

From the following information extracted from the book of Max Ltd. for the year 2019-20, calculate net cash flow from investing activities.

Additional information is given as follows:

- Depreciation charged on furniture during the year was $10,000

- Depreciation on machinery charged during the year was $25,000

- Machinery, the book value of which was $80,000, sold for $75,000

- Land was sold at a profit of $90,000

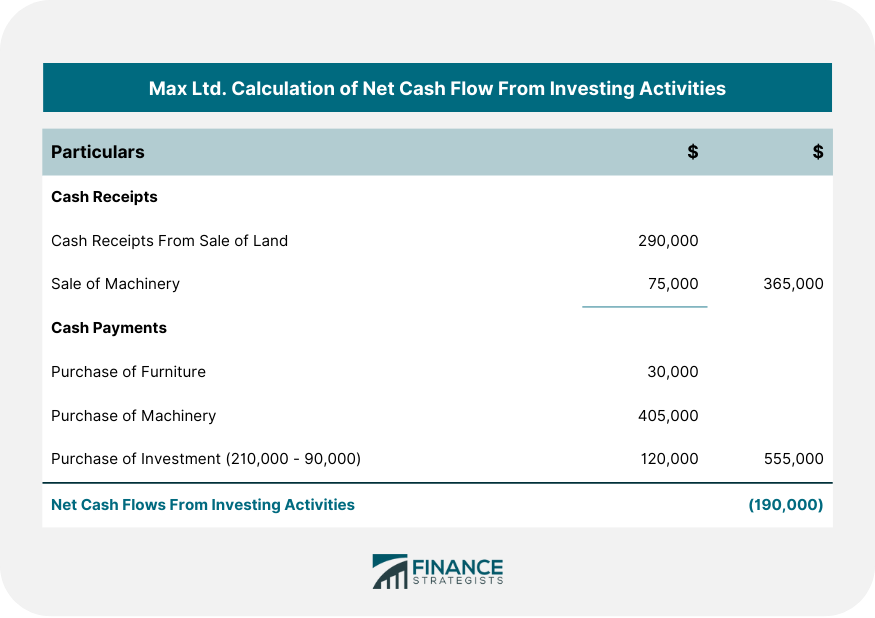

Solution

Note: $190,000 indicates cash outflows are more than inflows.

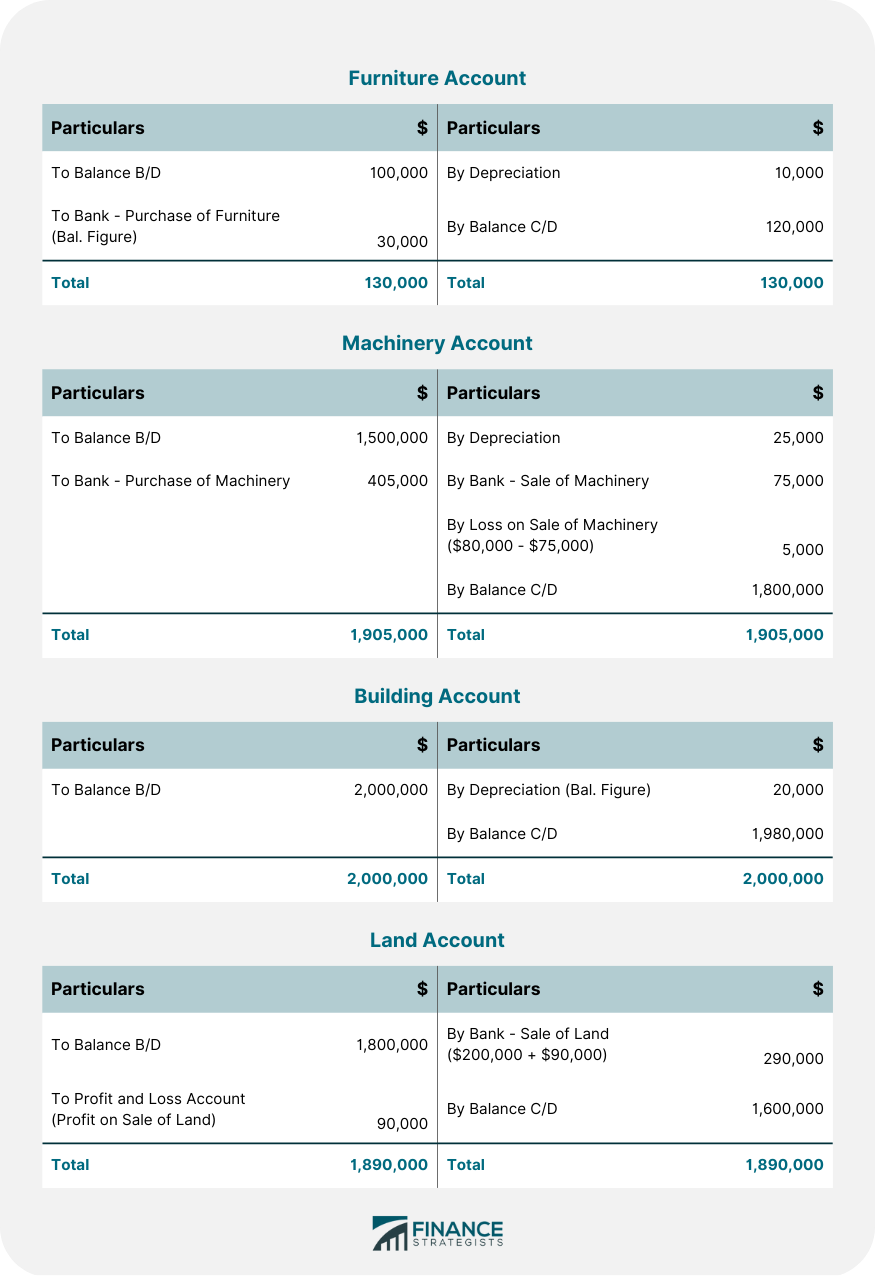

Working Notes

Problem 4

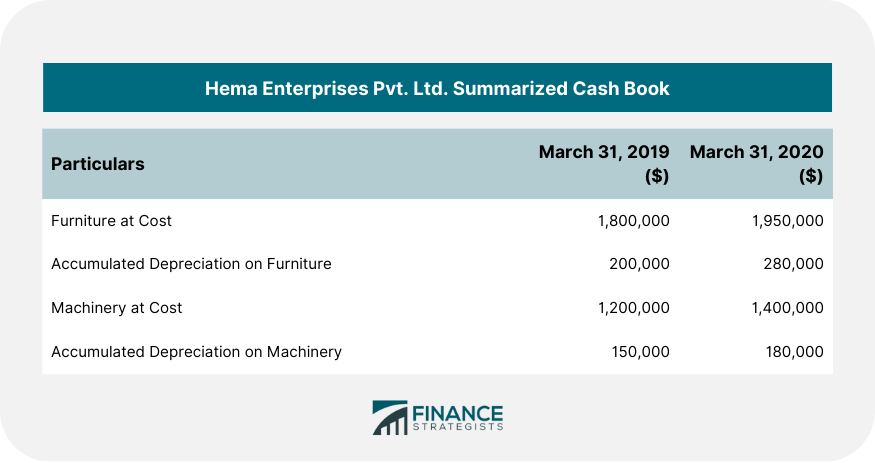

You received the following information from Hema Enterprises Pvt. Ltd. Calculate the net cash flow from investing activities.

Information relating to assets sold during the year 2020 is given as follows:

- Furniture costing $100,000 (accumulated depreciation $20,000) was sold for $70,000

- Machinery costing $100,000 (accumulated depreciation $30,000) was sold for $80,000

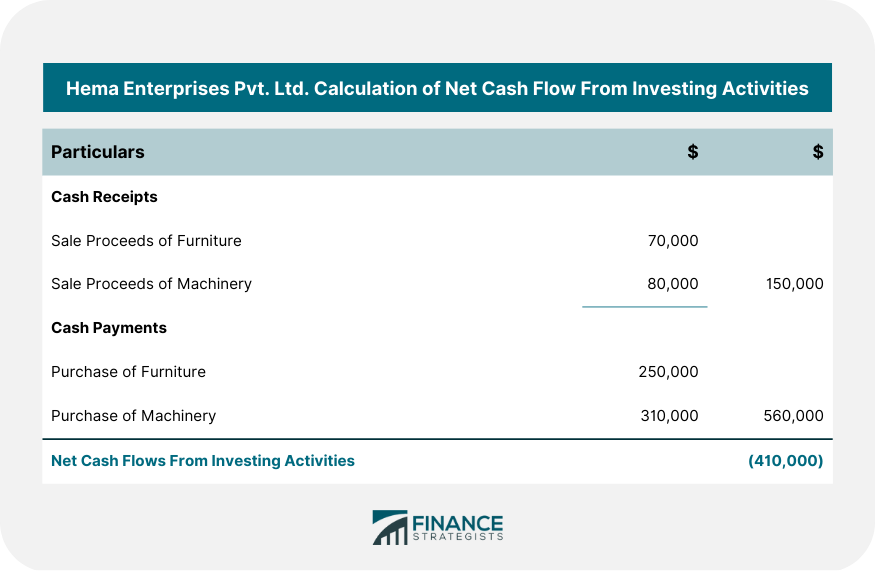

Solution

Note: Cash outflows are more than cash inflows ($410,000).

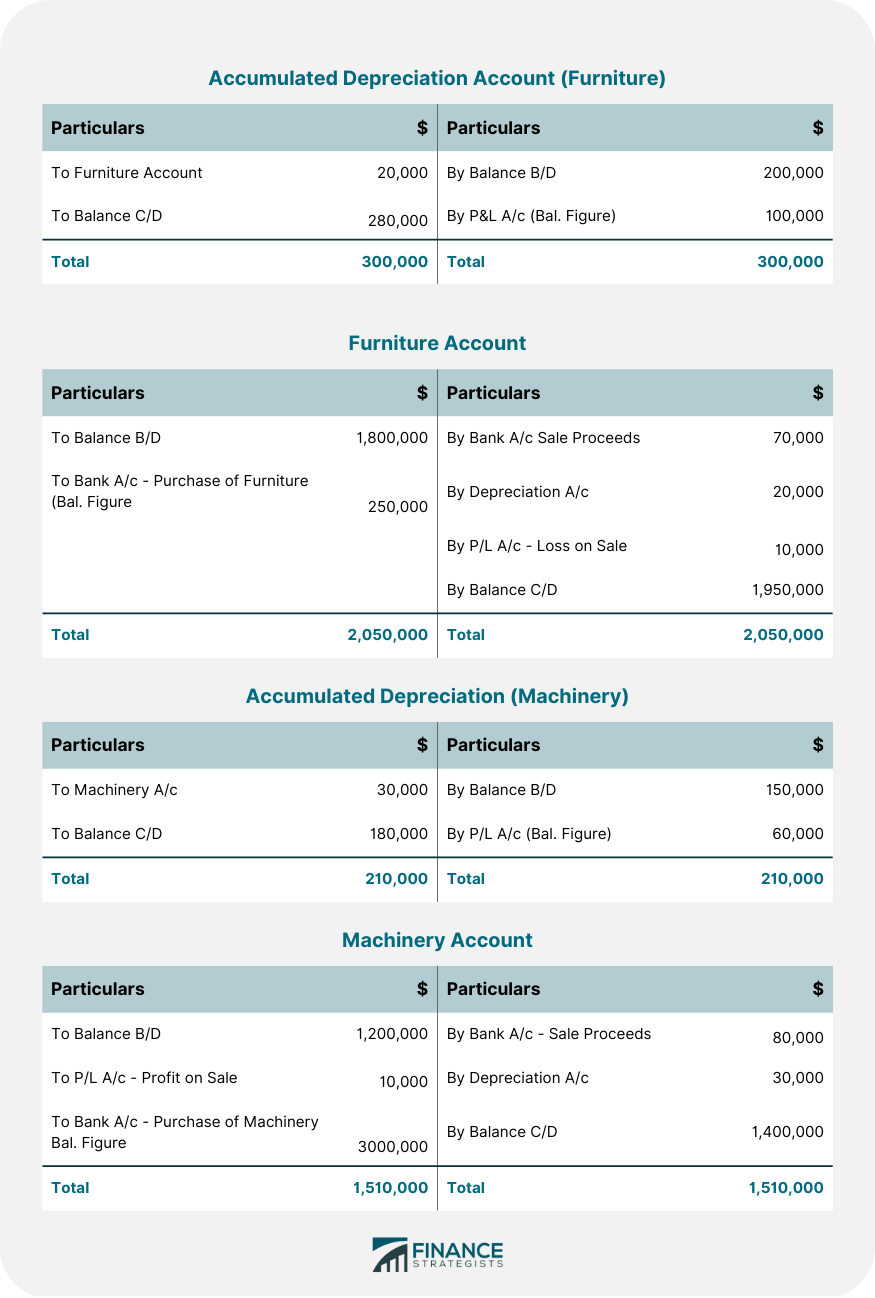

Working Notes

Problem 5

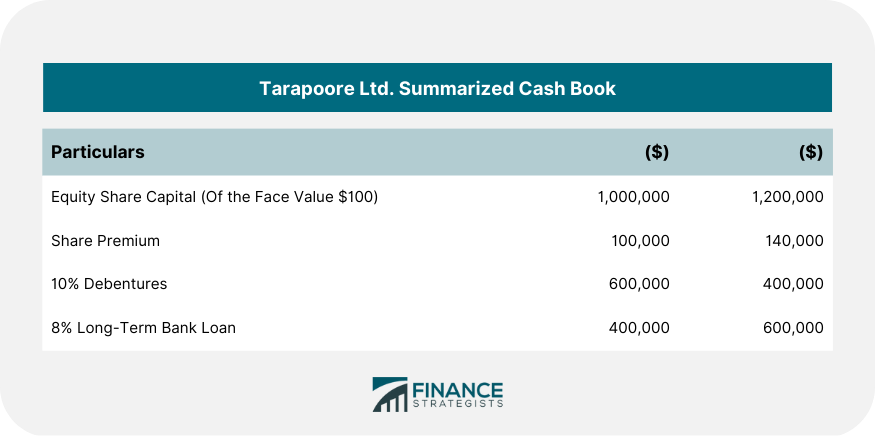

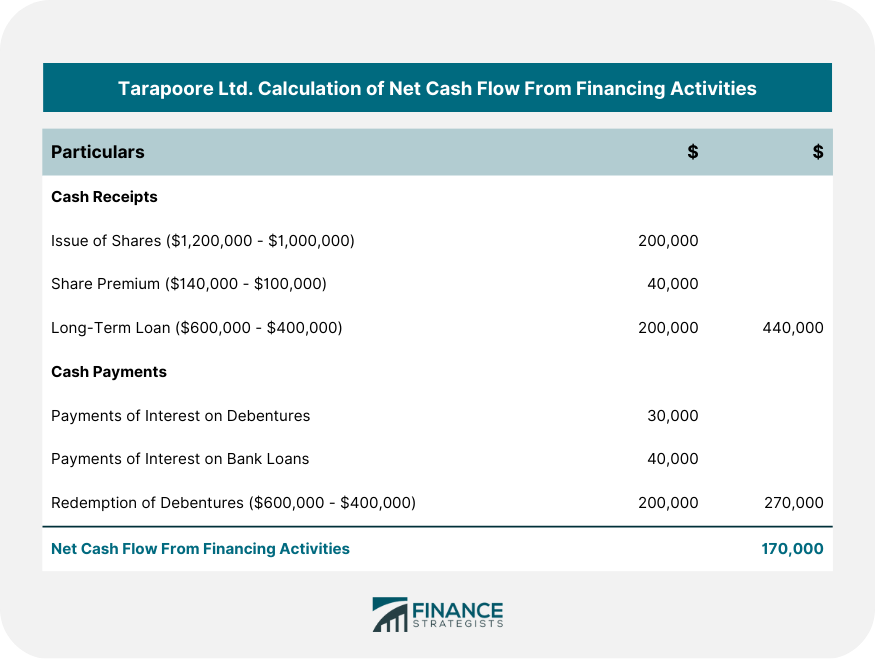

From the following information acquired from Tarapoore Ltd., calculate net cash flows from financing activities for the year 2019-20.

Note:Interest on debentures paid during the year was $30,000 and on bank loan $40,000.

Solution

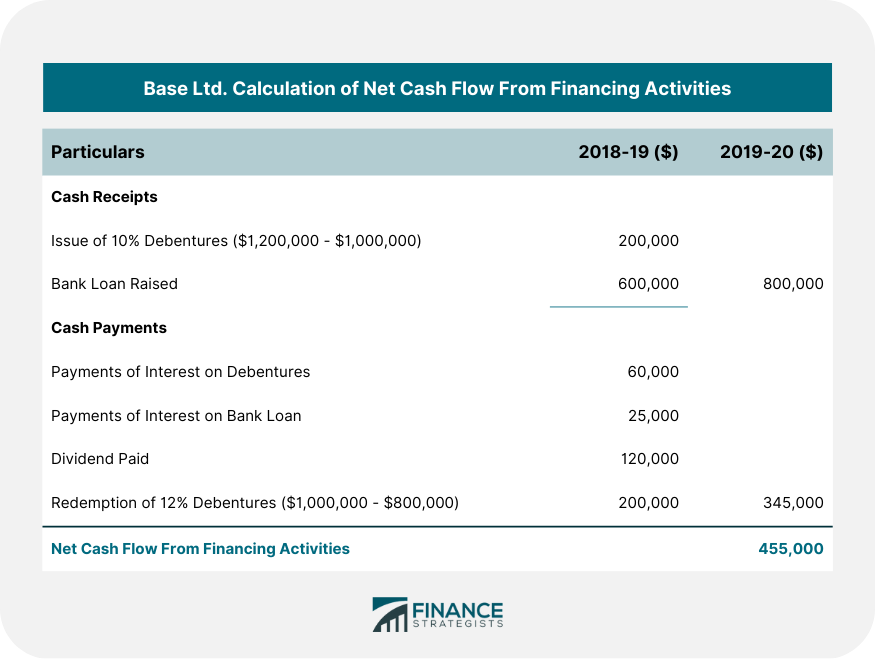

Problem 6

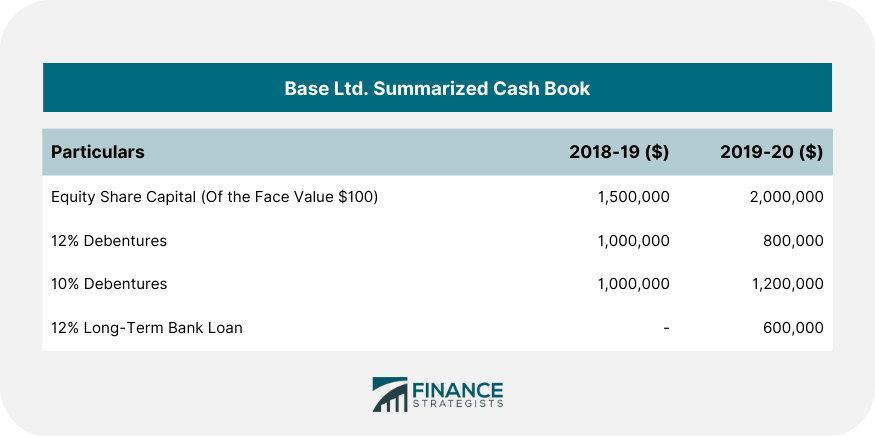

Base Ltd. provides the following information to you. Calculate net cash flows from financing activities for the year 2019-20.

Further information is given as follows:

- The company issued 5,000 bonus shares during 2019-20 to shareholders at face value

- Interest on debentures paid, in total, during the year was $60,000

- Interest on bank loan paid during the year was $25,000

- Dividends paid during the year amounted to $120,000

Solution